HMRC have released the draft Finance Bill 2020 which includes amendments to the off-payroll working rules which are due to come into force from April 2020. The draft Finance Bill includes amendments to the Income Tax (Earnings and Pensions) Act 2003 (ITEPA 2003) which will impact contractors operating through their own limited companies (commonly known as Personal Service Companies – PSCs).

The relevant extract of the draft Finance Bill can be seen here –

https://www.gov.uk/government/publications/rules-for-off-payroll-working-from-april-2020

Who will be impacted by the changes?

The rules will apply where services are supplied through a limited company to a client that is medium or large, operating in the private sector. The rules already apply for clients that operate in the public sector (regardless of size).

The draft Finance Bill 2020 confirms that in the private sector the smallest organisations will not be affected by the reform and will not need to determine the status of the off-payroll workers they engage. This relates to the end client, not the contractor.

The government intends to use the existing statutory definition within the Companies Act to determine whether or not a corporate client is small (turnover less than £10.2m, gross assets less than £5.1m and less than 50 employees).

Therefore, if the end client that you are contracting with is medium or large then they will need to decide whether the rules apply to your engagement.

Responsibilities of Stakeholders

Under the new rules, the end client will have to produce a status determination statement (SDS) which must include the client’s status determination and the reasons for reaching the determination. The Bill includes provisions that set out that all entities in the supply chain (i.e. recruitment agencies) are made aware of the client’s determination and the reasons for the conclusion reached.

The legislation sets out that the client must take ‘reasonable care’ in producing the SDS. If the contractor disagrees with the SDS, they can submit representations to their end client who must respond within 45 days of receipt.

What will the impact be?

If your client’s assessment is that the assignment is outside IR35 then the director/shareholder can continue to extract profits in a combination of salary and dividends.

If your client’s assessment is that the assignment is inside IR35, all of the fees will be subject to income tax and National Insurance. This means that your take-home pay will be the same as if you were an employee.

In addition, there will be limitations on expenses that can be claimed through the limited company. For example, you would not be able to claim travel and subsistence expenditure.

A comparison is set out below:

What will my options be going forward?

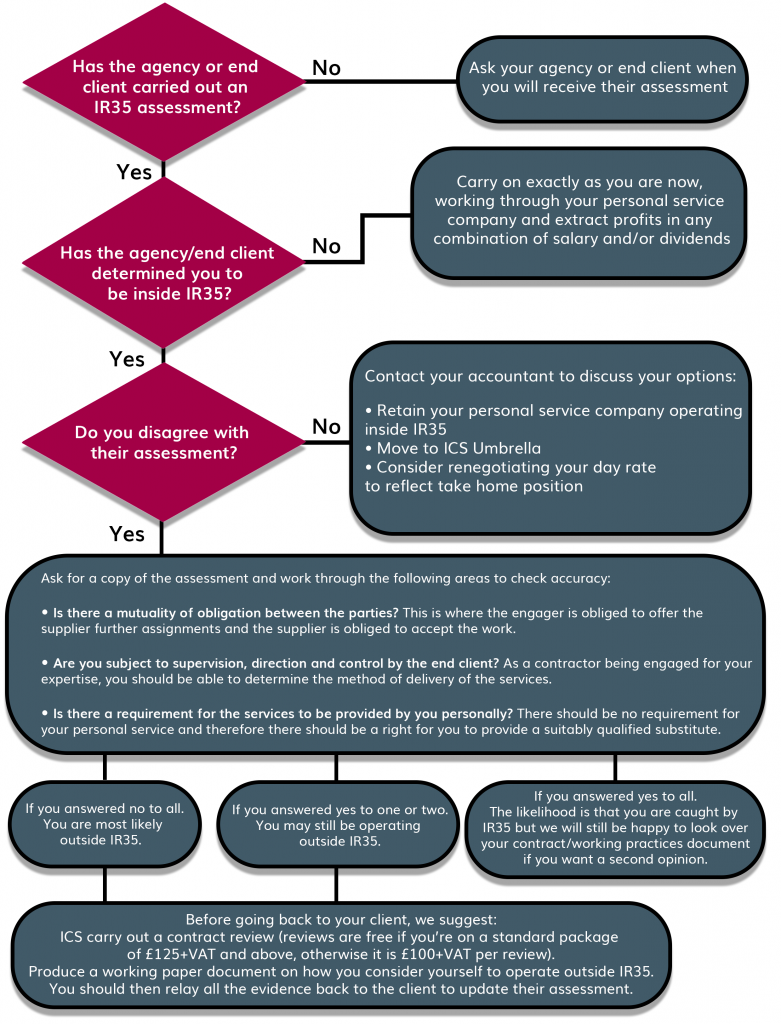

If your current project is expected to last until after 5 April 2020, we recommend that you contact your end client to establish when you can expect to receive your SDS. If your client has started their assessment on you then you can follow through our decision tree to work out what your next steps should be:

If you have any questions please don’t hesitate to get in touch with our friendly team on 0800 195 3750 or email info@icsuk.com